- Details

- Written by: Stephen McHugh

- Category: Static content

- Read Time: 1 min

- Hits: 2

|

||

|

||

|

- Details

- Written by: Stephen McHugh

- Category: Static content

- Read Time: 4 mins

- Hits: 2

All Anglo-Suisse Capital Limited email is subject to the following:

Anglo-Suisse Capital Limited is registered in England with number 3833541. Its registered office is 168 Fulham Road, London SW10 9PR. Anglo-Suisse Capital Limited is authorised and regulated by the UK Financial Conduct Authority under the UK Financial Services and Markets Act 2000. This e-mail and any attachments are not in any circumstances intended to constitute advice to any person who receives them or any other person buying, selling or subscribing for any investment or engaging in any other transaction. Any person seeking such advice should consult a person authorised under the UK Financial Services and Markets Act 2000 to give such advice. Nothing in these documents constitutes an invitation or any inducement to any person to engage in investment actively (as defined in section 21(8) of the UK Financial Services and Markets Act 2000) with Anglo-Suisse Capital Limited or any other person. This e-mail is being sent to professionals for informational purposes only and does not constitute an offer to sell or to buy any securities nor to give advice on the buying or selling of securities. Before making any investment, potential investors should carefully read the relevant offering memorandum or prospectus which contains the appropriate information needed to evaluate the investment and provides important disclosures regarding risks, fees and expenses. Any offer or solicitation will be made only through relevant offering memorandum or prospectus and subscription agreement and is qualified in its entirety to the terms and conditions contained in such documents.

For U.S. persons only: This e-mail is a product of Anglo-Suisse Capital Limited. The person who prepared this e-mail is resident outside the United States of America (U.S.) and is not an associated person of any U.S. regulated broker-dealer and therefore is not subject to supervision by a U.S. broker-dealer and is not required to satisfy the regulatory licensing requirements of FINRA or required to otherwise comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public appearances and trading securities held by a research analyst account. This e-mail is intended for distribution by Anglo-Suisse Capital Limited only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S. Securities and Exchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (“SEC”) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon this report and return the same to the sender. Further, this e-mail nor any of its contents may not be copied, duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional Investor. In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct certain business with Major Institutional Investors, Anglo-Suisse Capital Limited has entered into an agreement with a U.S. registered broker-dealer, Marco Polo Securities Inc. ("Marco Polo"). Transactions in securities discussed in this e-mail should be effected through Marco Polo or another U.S. registered broker dealer.

For further information, please do not hesitate to contact Charles Hancock (

- Details

- Written by: Stephen McHugh

- Category: Static content

- Read Time: 6 mins

- Hits: 2

VoiceBase - Frequently asked questions

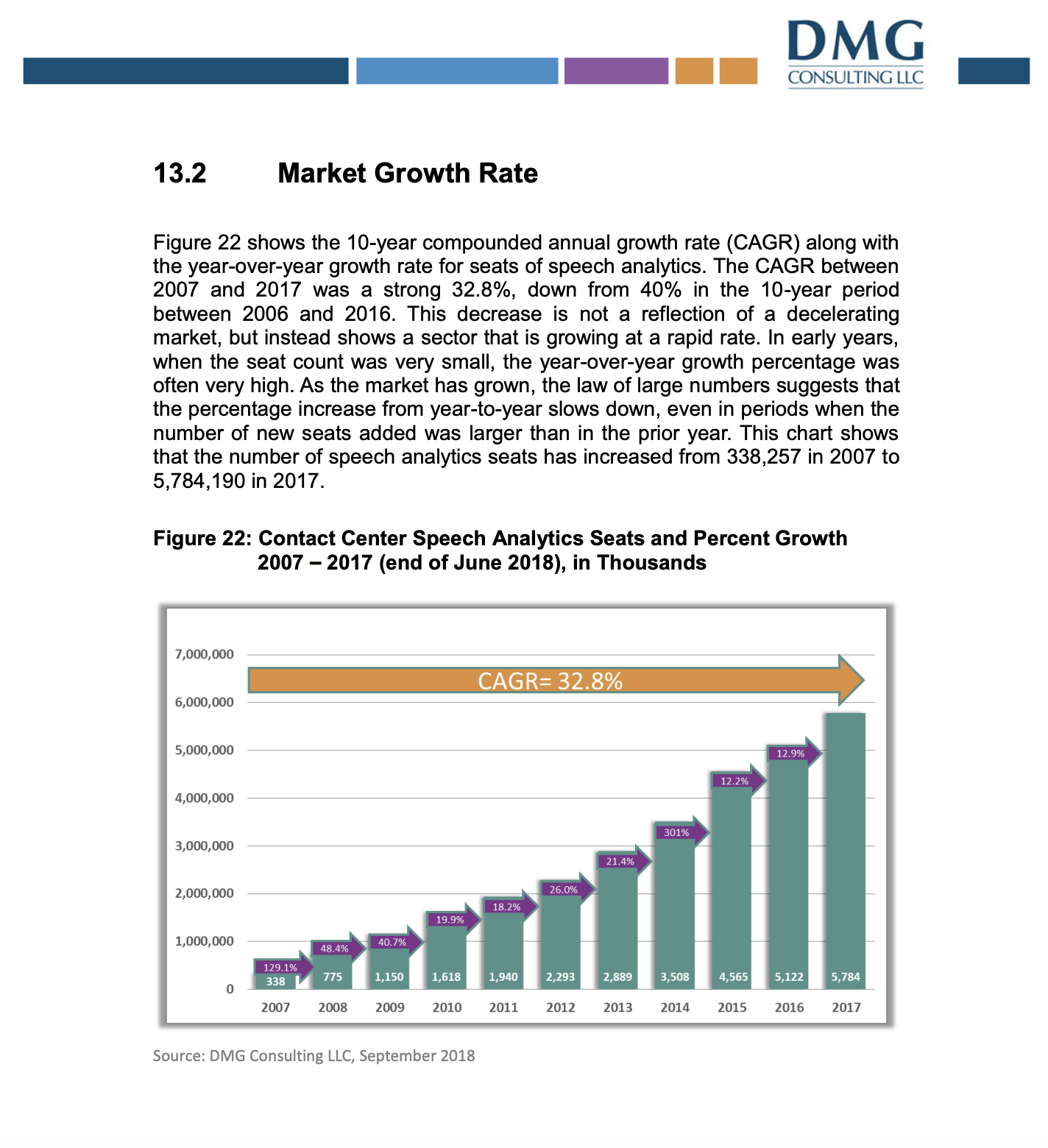

- What is the expected growth for the voice analytics market?

The voice analytics software market size is expected to grow from USD 657 million in 2019 to USD 1,597 million by 2024, at a Compound Annual Growth Rate (CAGR) of 19.4% according to Voice Analytics Software Market 2019 Industry Research Report.

Factors such as growing need to extract insights from customer interactions, rising demand to monitor improve agent performance, and growing focus on risk and fraud detection are expected to drive the market growth. Moreover, growing impact of AI and improving individual experience and increasing adoption of cloud-based solutions are expected to create ample opportunities for Voice Analytics Software solution vendors.

Source: link to the report...... -

Why are there no VCs invested?

The main reason is when we first started the company, our competitor Nuance was suiting every startup in our industry, so VCs stayed away. We found a family office that invested anyway, now many years later, we are the only speech analytics company with the maturity to handle large enterprise clients.Our largest shareholder is a family office that was first money into Sun Microsystems. He knew my co-founder who was one of the first people at Ringcentral and he tried to hire him for one of his investments that was a competitor of Ringcentral. Jay stayed did all the major deals to make Ringcentral a multi-billion dollar company and IPO. They realized we were doing the same here.

More recently, we've seen a couple of VCs make large investments in adjacent industries. Some of these companies were clients of ours, but since we are turning into an end to end solution - they are now slightly competitive.

-

What is the sentiment of the existing investors?

Very positive. VoiceBase has very supportive investors and they are happy with the performance. They fully trust and support the board and executive team. Some of them have recently participated in recent rounds, or are considering participating in current rounds. Our largest investors are family offices who have known and worked with VoiceBase for many years. -

What is the significance of the Poly MOU?

Most medium size companies ($200m-$500m revenue) do not have the IT departments or the expertise to deploy expensive, complex legacy solutions – so they tend to fly blind which poses enormous risks.The VoiceBase Online product, shares the same platform as the Developer and Enterprise products, but is specifically configured to provide a simple, easily deployable solution without large IT org overhead. The real magic happens when it is paired with a Poly headset – high fidelity voice and accuracy that is a decade ahead of current solutions.In addition, VoiceBase is partnering with Poly (signed MOU) to distribute this solution, using their 6,000 representatives. The service deploys to a new purpose-built headset and existing poly devices in less than an hour.

Beta customers will start in 1Q20 with product release in May 2020. Projection of 200,000 users by 2022 is conservative relative to Poly’s target of 400k customers.

VoiceBase is targeting $230m recurring revenue from the combined offerings by the end of 2022.

- How is the valuation justified?

- Aren't call centres declining?

No. In fact, seats are increasing. Call center seats have increased from 338k in 2007 up to 5.78 million in 2017.

Source: DMG Consulting LLC

Further, we believe stock prices are a good reflection of an industry. Teleperformance (TEP:FP) rent call-center services to the enterprise and their 5 yr performance is +283%.

-

Why have there been so many rounds?

Since there have been no VC rounds, which typically raise higher amounts at earlier stages, VoiceBase has been able to be more prudent with a higher number of rounds but each with a much smaller amount.Two reasons, first and main reason was it was at the request of the largest family office investor. Second, it meant less dilution for existing investors compared to raising more money than was immediately needed. Several of the rounds were led by the same family office. - What is the pricing model? (If I have a 1000 call centre staff what is the cost to implement?)

a) Developers: charged based on usage - pay as you go (per minute) - because often they don\'t know how successful their product will be

b) Enterprises: annual agreement with 1 year prepay - they know exactly how many minutes a year they do, so are comfortable with that.

c) Online: price per agent or seat

All 3 roughly translate to 1-2 cents/min despite the different payment structure.

- Is churn a factor?

The nature of the business is such that there’s very little churn. When a company is using VoiceBase analytics they have integrations and development work and data histories and custom models and predictors which makes it very very hard to leave VoiceBase.

Hence, even for the Developer ‘pay as you go’ vertical, they have programs that are so deeply integrated with our technology that churn isn’t a concern for VoiceBase.

- Which sectors are currently most represented in the 25 or so clients and how do you see that evolving?

Sectors is hard to describe. We apply to call centers across a broad range of industries. If we look at revenue, we get the most from call tracking industries and Telecom. However, the growth over the next few months is from a broad range of industries such as Dish (satellite TV), Macys (largest department store), Zillow (Real Estate Portal), Uber (ride share) and GoDaddy (Web Hosting). The common factor with these customers is the use cases, i.e. Sales, Service and Marketing.

VoiceBase recently presented to Fortune 500 companies at the Tableau Conference TC19 in Vegas and the range of companies we met probably best indicates what it will evolve towards. We can see that BANKING is number 4 and INSURANCE number 6. Generally banking, finance and insurance has a high demand for what we do.

- Why does VoiceBase seem more expensive than other voice analytics providers on a cost per user basis?

a) You are not comparing like-with-like. VoiceBase covers the whole stack of voice analytics (speech-to-text, keywords/topics, redaction, metrics, categories and prediction - AI). The cost per user of competitors usually only covers one element.

b) VoiceBase is much more accurate (e.g. 95% on text-to-speech v Google's 65%), which is necessary for the other analytics elements.

c) VoiceBase has no serious competition in redaction, the removing of sensitive sate (e.g. credit card numbers). Not just required for compliance, it's essential before any large scale data analysis can be carried out.

d) Unlike most competitors, VoiceBase is fully integrated into the enterprise's existing systems, including CRM, meaning its UI fits in with the customer. This makes changing very difficult.

If you have any further questions please do not hesitate to contact us at:

- Details

- Written by: Stephen McHugh

- Category: Static content

- Read Time: 1 min

- Hits: 2

Expanded information page for Max's managed account campaign

- Details

- Written by: Stephen McHugh

- Category: Static content

- Read Time: 1 min

- Hits: 2

Global Blockchain Ventures (https://gbv.fund) is a blockchain technology focused venture capital fund, specialising in blockchain enabled applications within synergistic technology platforms including Internet of Things, MedTech, and Artificial Intelligence. The GBV mission is to fund and support the most disruptive and promising projects with the ability to offer actual, practical blockchain enabled solutions to benefit the global economy.

GBV sees blockchain technology (DLT) as a fascinating foundational technology that will spur innovation and advancements across all industries. Blockchain technology, in many cases, is not a competitor to existing technology but rather a structural, beneficial stimulant that will ultimately converge with other technology.

The GBV Team

GBV was formed to leverage the decades of experience of our investment team and offer sophisticated investors a unique fund structure to participate in blockchain opportunities. See the team here.

The GBV Eco-system

![]()

(See the current portfolio here)